Learn All About Saving For Higher Education.

- Home

- Learn

For parents, grandparents, really anyone interested in saving for higher education, this learning resource is designed to answer most all your questions about college savings options, Ohio’s 529 Plan, and when to start.

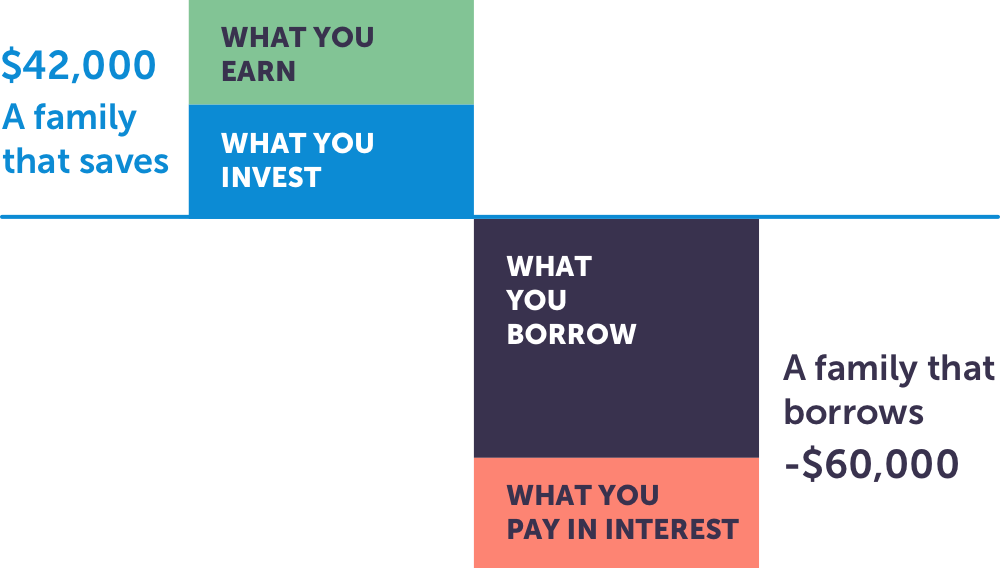

More savings equals less debt equals more options in life.

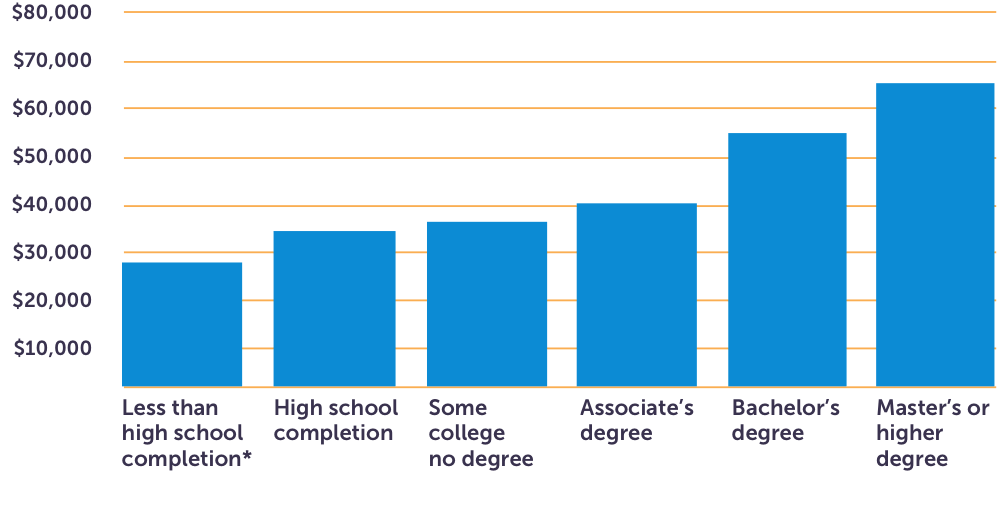

Maybe your child will go to a traditional college. And then grad school. Maybe it will be a community college. Or trade school. Or beauty school. Or welding school. Perhaps some kind of apprenticeship. You simply can’t know.

So as parents and grandparents, we try to create possibilities. Every dollar you can save now helps keep future student debt from getting out of hand later. While some borrowing may be necessary — that’s a family decision — it’s also a more expensive path to take. Our mission is to help you go into the future informed and prepared for whatever lies ahead.

NOTE: Data are based on sample surveys of the noninstitutionalized population, which excludes persons living in institutions (e.g., prisons or nursing facilities) and military barracks. Full-time, year-round workers are those who worked 35 or more hours per week for 50 or more weeks per year.

SOURCE: U.S. Department of Commerce, Census Bureau, Current Population Survey (CPS), Annual Social and Economic Supplement, 2019. See Digest of Education Statistics 2019, table 502.30.

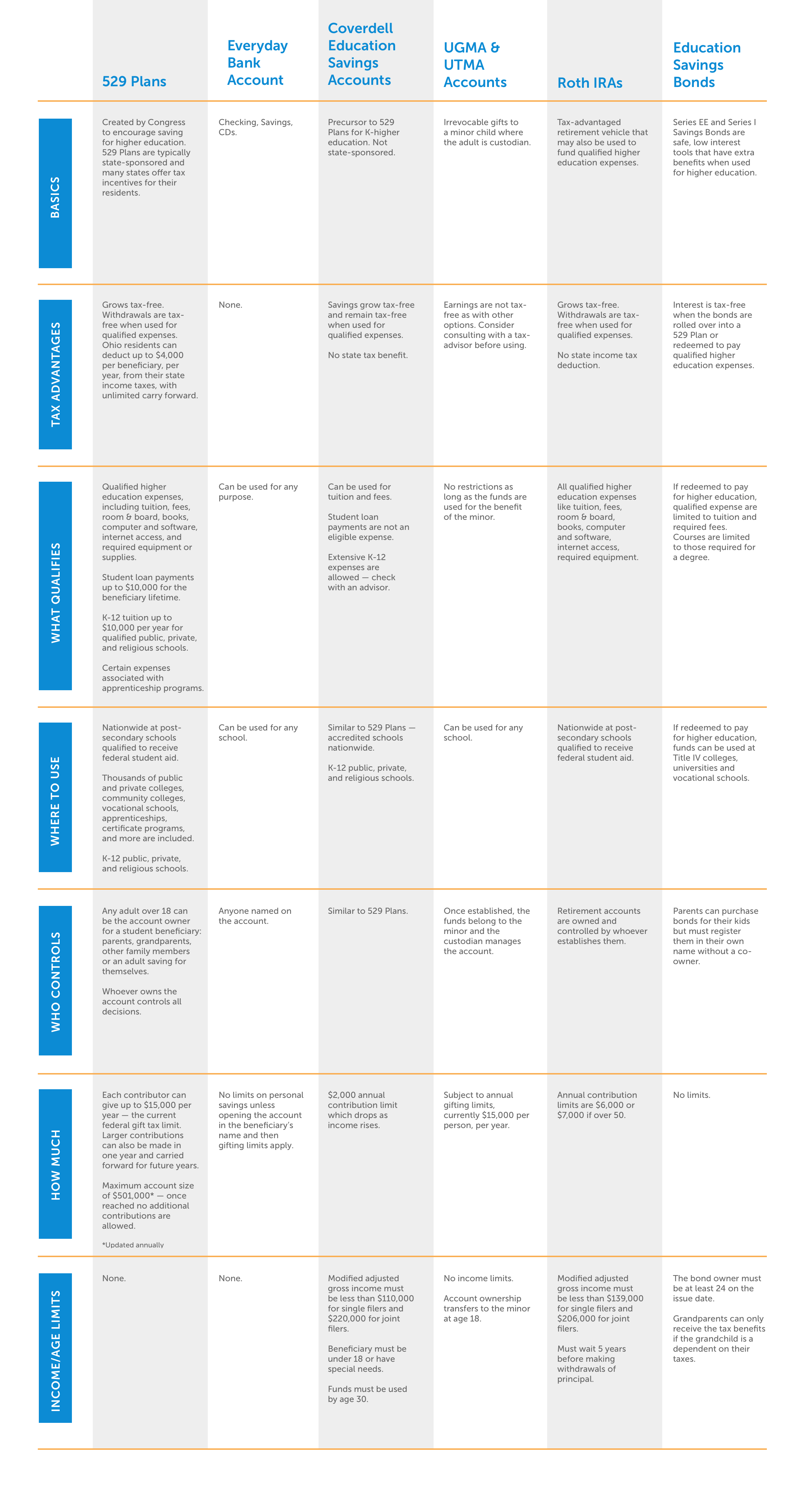

Comparing bank accounts with 529 Plans – plus all the other ways to save.

The vast majority of families save for college in an everyday bank savings account or a 529 Plan — sometimes both. Many start with a savings account because it’s easy but, over time, get frustrated with the lack of growth.

529 College Savings Plans were created to help families save for whatever comes after high school and grow the kind of college fund you’ll likely need. Much like the now-common 401(k) retirement plan, the federal government created these plans to help all families, regardless of income level, afford the ever-increasing cost of higher education.

The idea is simple. If your money can be invested in ways that tend to grow more over the long term, that’s good. And if that growth is tax-free, that’s even better. And if that growth stays tax-free when you spend it, that’s ideal because you’re more likely to borrow less. We’ll get into all the specifics later, but that’s the idea — more savings, less debt.

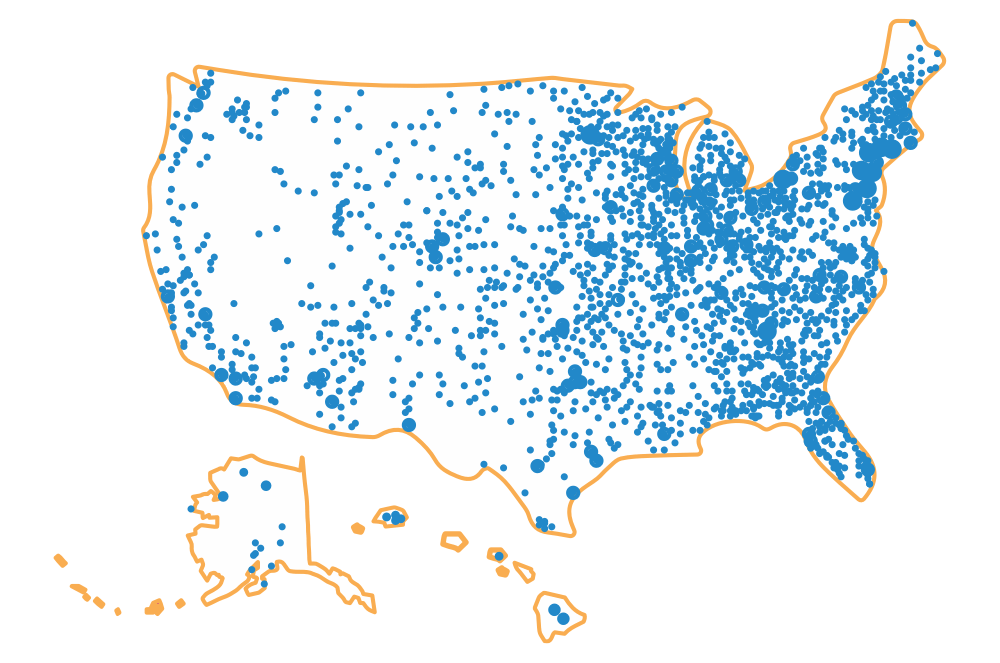

Get the facts about Ohio’s 529 Plan starting with where you can use it.

When the federal government created Section 529 of the Internal Revenue Code in 1996, many states began to launch them. Ohio already had a plan called the Ohio Prepaid Tuition Program, which offered prepaid future tuition units whose value was tied to tuition costs at Ohio’s 13 public universities. That program closed to new accounts and new contributions at the end of 2003.

Today, Ohio’s 529 Plan is an ideal way for parents and grandparents – in Ohio or any state – to build a real plan to help pay for whatever school comes after high school, wherever that might be, nationwide.

College savings grow tax-free.

Long-term compounded growth is something investment people get excited about. It basically means the money you made is making even more. In short, you’re crushing it. And when that growth is tax-free, you aren’t giving a chunk of it back every year. Even better.

Withdraw your savings tax-free for “qualified expenses.”

When it’s time to use the money in your 529 Plan, it stays tax-free as long as you use it on qualified educational expenses. Don’t worry, it’s all the big stuff: tuition, fees, room and board, books, supplies, computers, and more.

State tax deduction up to $4,000 per child, per year.

If you’re an Ohio taxpayer, it gets better. Because you’re eligible for a state tax deduction every year you put money in your 529 Plan(s). The current deduction is $4,000 per child, per year. Yes, you can put in way more than that to get tax-free growth and then take the state deduction in $4,000 chunks in future years.

Dozens of low cost investment options from leading financial firms.

Many of our investment options are managed by Vanguard, known for its extremely low cost approach to investing, with additional options from Dimensional Fund Advisors. We offer options for every comfort level when it comes to risk, even FDIC-insured tax-free bank accounts from Fifth Third Bank. You can see all the options in the Plan section of our website

$25 minimum deposit, no annoying fees.

The idea is to make this a plan for all, so it only takes $25 to start or add to Ohio’s 529 Plan. Beyond that, we don’t ever charge annoying fees — like so-called “low balance fees” – that penalize people for trying to do the right thing.

Don’t worry about hurting your child’s chances for future scholarships or grants.

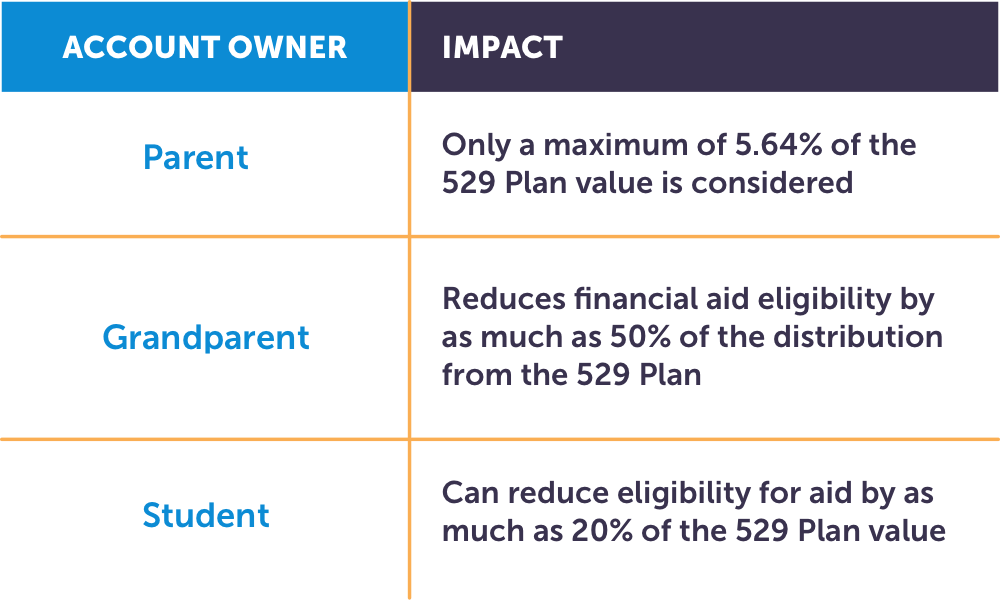

529 Plans are intended to be part of the big picture of covering higher education, which typically includes savings, financial aid, and student loans. When kids are nearing the end of high school and you start calculating what’s called “Expected Family Contribution,” you’ll be happy you saved in Ohio’s 529 Plan because if parents own the account, only 5.64% of the account value is considered in that calculation. So yes, this is how you save and max-out student aid.

Flexible options if your child doesn’t need or use the money.

A parent typically owns the account. A child is the beneficiary. That means you call all the shots. If one child doesn’t need or use the 529 account, simply transfer your savings to another eligible family member, use it for your own education, hold it for future use, or withdraw the money. With this last option, you would be taxed on the earnings and the IRS would assess and a 10% penalty.

No age or income restrictions.

You can start Ohio’s 529 Plan for any aged child. You can start one for your own continuing education. You can be a parent, grandparent, or another family member. Your income can be at any level.

How grandparents and other family members can help save for college.

Ohio’s 529 Plan is easy for grandparents, aunts, uncles, cousins, even friends to use.

We hear it a lot — “I want to be a positive part of my grandchild’s life … I want to give opportunities, not just toys.” Ohio’s 529 Plan can be an important part of your plans, whether you want to make an occasional gift or own the account and build a substantial 529 plan.

Before you start the college savings conversation, have a plan in mind.

Talking about money can be a little awkward, but trust us on this — parents would love your help with college savings. We can help you understand your options so when you have that conversation, you already have an idea of what you want to do.

If you haven’t read the basics of Ohio’s 529 Plan, now is a good time to do that. But there are some important grandparent/relative-specific things to also consider.

Decide first on account ownership.

The future student is the beneficiary. The important question is who owns the account? This is a personal decision, but it’s important to understand how account ownership affects you and the child.

Your options:

- Set up and own a new account whether the parents have one or not

- Contribute to one the parents or another relative already own

One key consideration is future financial aid.

As you can imagine, the world of college financial aid is very complex. Currently, when Ohio’s 529 Plan is owned by a parent, it has very little effect on the future student’s financial aid. However, that changes when the funds are coming from somebody else.

Owning the 529 Plan yourself.

You might have many reasons to want to own and control the account. It’s your money and your choice. If you choose this path, just make sure you stay actively involved in managing the funds and making investment choices. As college nears, you’ll need to get up to speed on the latest rules to avoid harming your grandchild’s ability to maximize financial aid.

Adding to an existing 529 Plan.

This couldn’t be simpler. You give anywhere from $25 up to the legal gifting limit. You can do this right from our website — just look for the “Make A Gift” button near the top — or you can always send a check. The account owner can provide their UGift® code to contribute online.

The account owner decides who uses the 529 Plan funds.

Let’s say the child designated as the beneficiary decides not to go to college.

The account owner can:

- redistribute the funds to other children (including other grandchildren or adult children) in the family

- use the funds for their own education

- pay up to $10,000 of student loan debt for each sibling of the original beneficiary

- withdraw the money, paying taxes and a 10% penalty only on any earnings, not the principal

While many choose to let the parents be the account owner and simply have an open, honest conversation about their wishes, the option to own your own account is entirely in your hands.

How much can you deposit into Ohio’s 529 Plan in a year?

You have options here as well — the annual gifting limit and also the 5-year election.

- Annual gifting limits are up to $16,000 as an individual and $32,000 as a married couple to each child without triggering a federal gift tax.

- The 5-year election lets you really jump-start their college fund and take maximum advantage of tax-free compounding. Single filers can make a one-time $80,000 contribution and married couples can give $160,000 per child. Talk with your tax advisor if this strategy is appealing.

529 Plan experts are here for you.

While we can’t offer any kind of investment advice, our customer service representatives have extensive knowledge about Ohio’s 529 Plan. We can help answer questions about the plan, guide you through account opening, and help address your specific and personal concerns.

When families typically start and add to their college savings.

Time is a college saver’s best friend.

The more time you have, the less money you typically have to plunk down to reach a goal. That’s just how long-term compounded growth works. So the sooner you can start, even if it’s small, the easier it will be to reach your goal.

Like your retirement plan, automatic deposits work best.

It's simple to securely link your bank account to make direct deposits to Ohio’s 529 Plan (also eventual withdrawals). Over half of our savers use the automatic feature and you can set it as low as $25 per deposit at whatever time interval works for you.

College savings strategy tips from 529 Plan account holders.

Parents overwhelmingly say they “feel so much better” after starting a 529 Plan. It’s not about how much money they saved. It’s more about moving in the right direction.

Pregnancy

BIRTHDAYS

Money Moments

Firsts

early graduations

Kindergarten

Middle school

.svg?sfvrsn=8145af12_0)